The Greatest Guide To Will I Lose My Tax Refund When Filing Bankruptcy

We worth your rely on. Our mission is to offer viewers with exact and impartial details, and We've editorial expectations in position to make certain that comes about. Our editors and reporters comprehensively reality-Verify editorial information to make sure the information you’re reading through is exact.

Filing bankruptcy will influence your credit score rating for so long as it appears on your own credit report, while the destructive affect does diminish as time passes.

Although the repayment prepare itself is often challenging beneath Chapter thirteen. It need to tackle a few differing types of creditors: priority, secured and unsecured.

There are many techniques you must just take to get ready for bankruptcy and correctly file your petition. An attorney can help you navigate these ways in order to sooner or later total your repayment approach.

There are several advisable actions you normally takes that will support your bankruptcy filing go as effortlessly as is possible. These steps include things like:

In conditions exactly where the filer has plenty of assets and their exemptions are reaching capacity, it may be sensible to attend to file for bankruptcy until eventually you have got received your tax refund.

Should here you be filing Chapter thirteen, the bankruptcy court docket will evaluate the level of your secured and unsecured debts and identify if you qualify.

Accordingly, just after the proper level of tax is set with the IRS, bankruptcy court docket, or Tax Courtroom, the IRS may possibly evaluate the tax owing versus the bankruptcy estate and issue a see and demand for payment.

Typically, the automatic continue to be to collect taxes carries on right until possibly the bankruptcy court check out here docket lifts the stay, the bankruptcy situation is closed or dismissed, or perhaps the debtor receives a discharge.

our firm’s number 1 target is that can help inhabitants get and remain from financial debt. Let us make it easier to get by way of your toughest moments.

Often known as the 'liquidation chapter,' Chapter 7 is utilized by persons, partnerships, or corporations who may have no hope for repairing their financial predicament.

With you can find out more the assistance with the courtroom, both you and your creditors will layout a repayment program that lasts from three to five years. Once the choose approves your proposal, you will send month-to-month payments into a courtroom-appointed trustee. They will gather and distribute your payments towards your creditors for your period of your respective why not try here agreement. Soon after, any remaining debts are discharged. Advantages of filing for Chapter thirteen bankruptcy

Tax refunds are specifically tricky to deal with, simply because you may owe taxes from a time previous to your bankruptcy and wikipedia reference you could proceed accruing taxes When you file.

The sixty-day interval to notify the trustee whether or not the return is acknowledged as submitted or has become picked for examination won't begin to run until a whole request package is obtained with the IRS.

Amanda Bearse Then & Now!

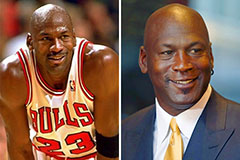

Amanda Bearse Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Elin Nordegren Then & Now!

Elin Nordegren Then & Now! Elisabeth Shue Then & Now!

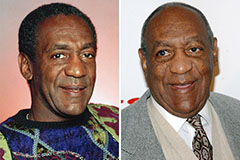

Elisabeth Shue Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!